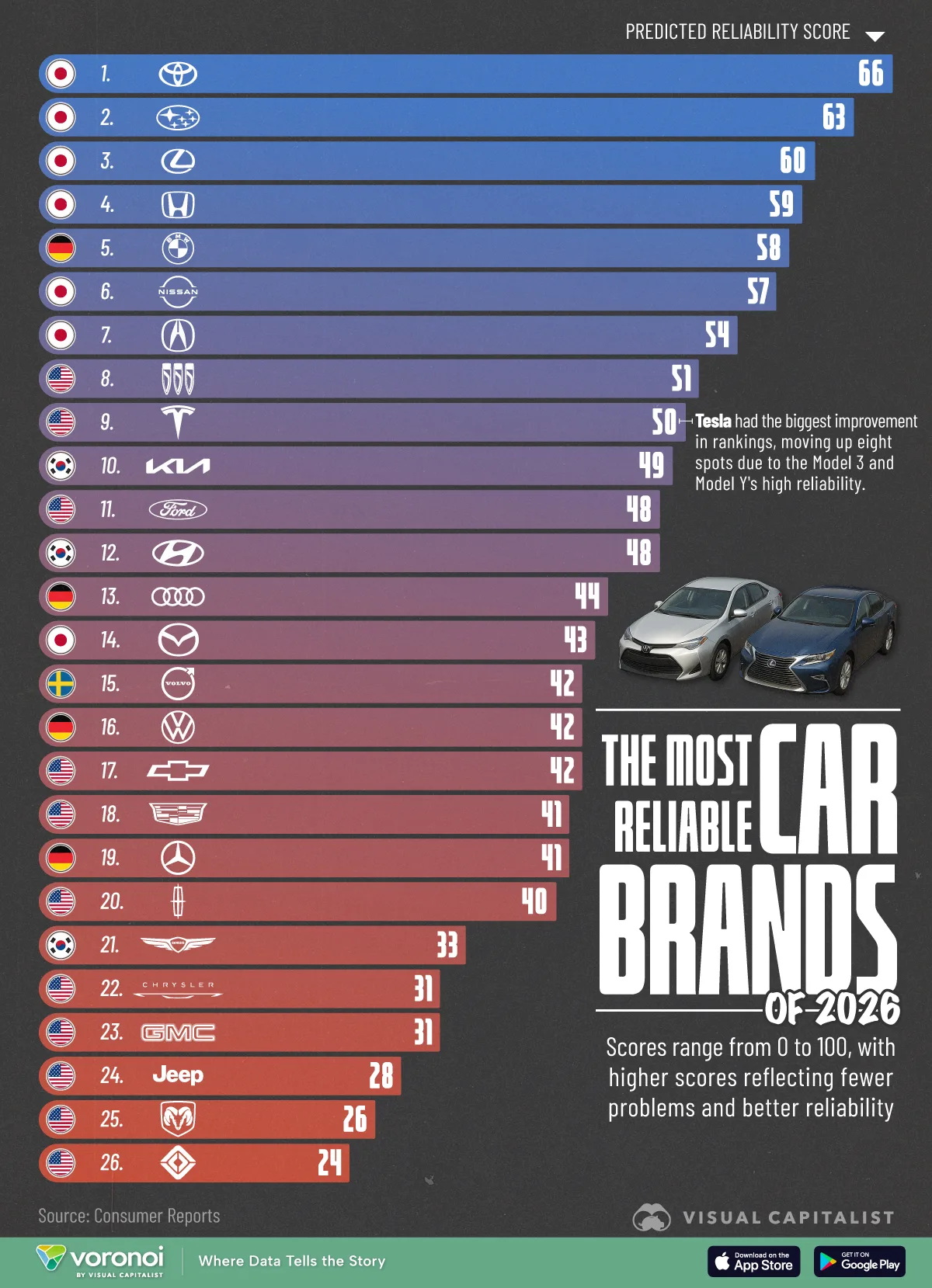

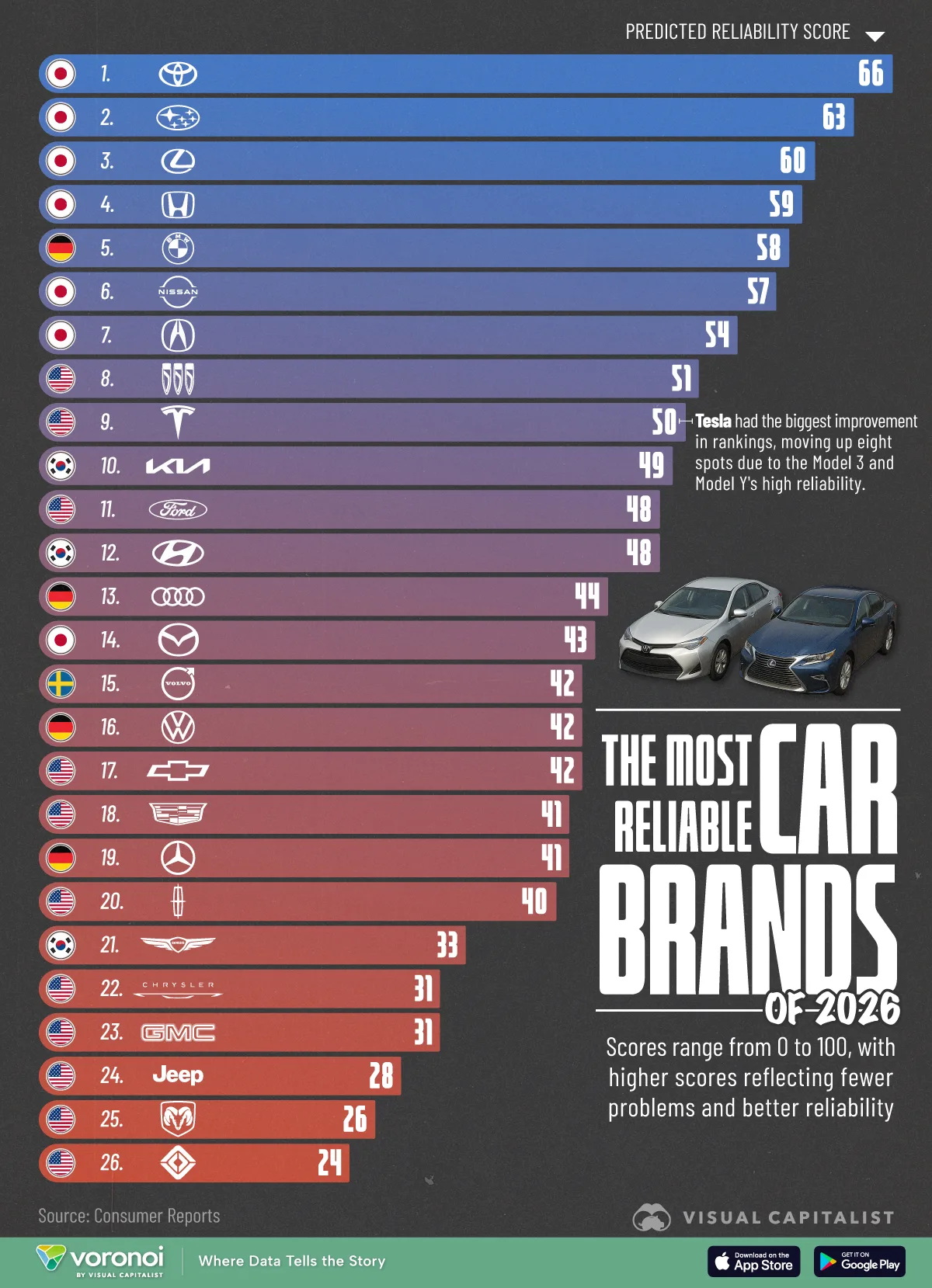

Most Reliable Car brands in 2026 ranked by predicted reliability scores.Toyota, Subaru, and Lexus top the 2026 rankings, reinforcing Japan’s long-standing reputation for vehicle reliability.Tesla recorded the biggest improvementRead More

Most Reliable Car brands in 2026 ranked by predicted reliability scores.Toyota, Subaru, and Lexus top the 2026 rankings, reinforcing Japan’s long-standing reputation for vehicle reliability.Tesla recorded the biggest improvementRead More

Africa’s electric vehicle (EV) market is accelerating rapidly — projected to reach $4.2 billion by 2030, more than double its current value, according to market research firm Mordor Intelligence. Yet most EVs still depend on griRead More

Imagine spending over ₦300 million on a car… just to regret it months later.Popular Nigerian businessman and forex trader Habby FX has revealed that he regrets buying the Tesla Cybertruck, a purchase that once broke the internetRead More

Max Verstappen is one of the best Formula One drivers in the world. But if you ask him about racing in the IndyCar Series, he makes his fears very clear.“It’s just the risk of a big crash is big, and of course, I know in F1 therRead More

Let’s talk about Converted Cars and few common ways to identify converted cars real quick.If you’ve been checking cars lately, especially Tokunbo or auction rides, you’ve probably come across the word “converted.”Here’s what it Read More

Nigeria’s car market shifts to high-end SUVs as import costs rise — Bassey-Duke The Managing Director and Chief Executive Officer of Stock Motorcars Limited, Esu Bassey-Duke, has revealed that high-end SUVs are currently leRead More

I believe SUVs are formidable 2nd Cars that people have come to a position that they are needed for status - Church, Parties, Business events, Image

How NEV Electric is Using Local Manufacturing to Solve Nigerias Mass Transit Crisis and Power a Clean Future As Nigeria marks 65 years of independence, attention is shifting toward the next phase of freedom — one defined noRead More

Electric Vehicles: Richard Akpodiete outlines Nigeria’s path to adoption Nigeria’s transportation sector stands at a turning point as the country confronts the global shift toward cleaner, smarter, and more sustainableRead More

Why Do Some Engines Consume Too Much Fuel After A Few Years? I’ve noticed something common with many cars in Nigeria, after some years of use, the engine begins to drink fuel more than usual.Some people say it’s becauRead More

We Have Tested EVs in Ghana & CNG in Nigeria, and the Results Are Shocking — C&I Leasing CEO RevealsIn a captivating episode of The Coffee Table with Ugodre, Lenin Ugoji, the CEO of C&I Leasing, shared valuable insigRead More